Periodic Inventory Using Fifo Lifo and Weighted Average Cost Methods

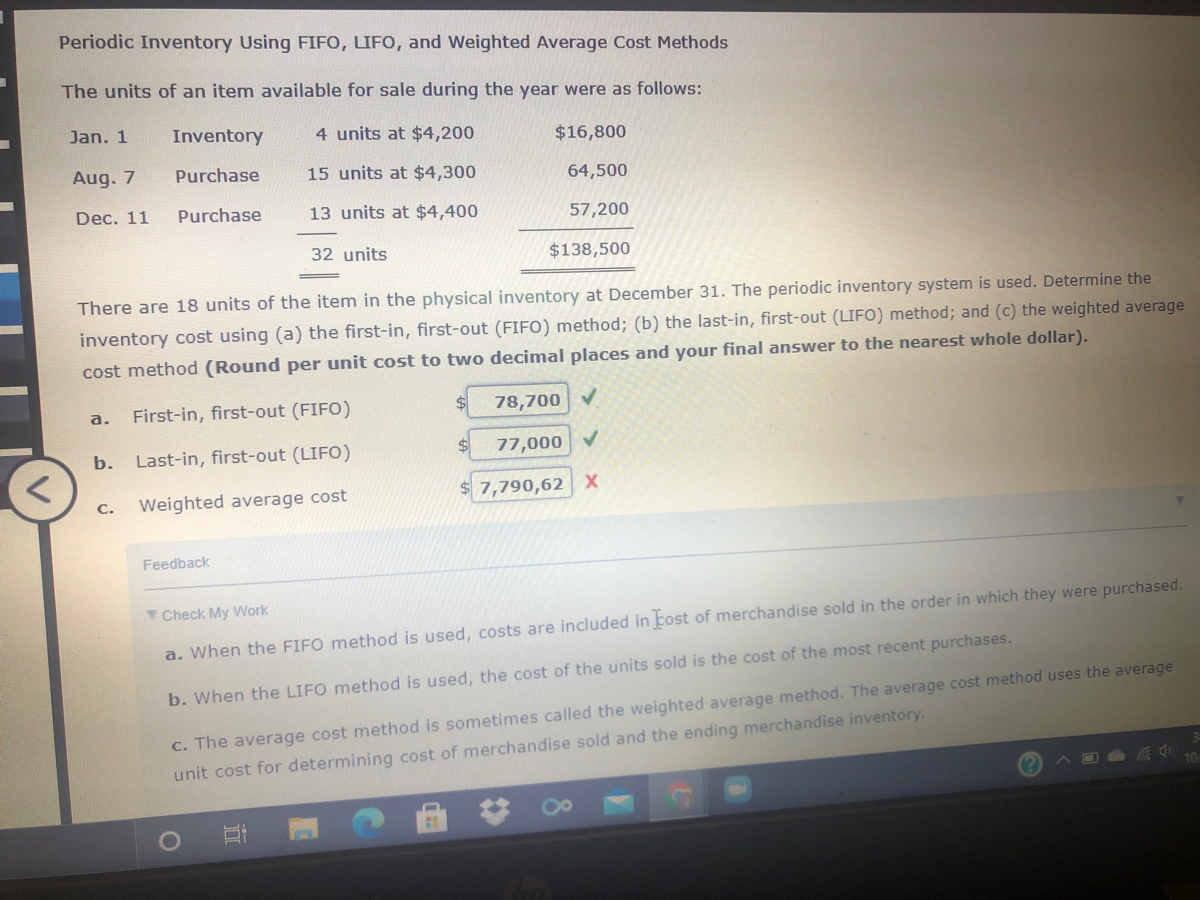

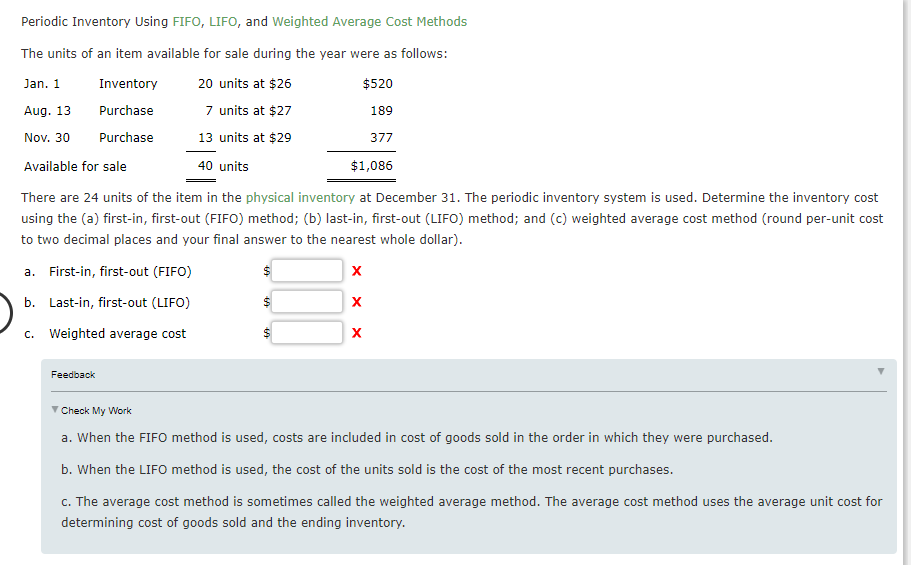

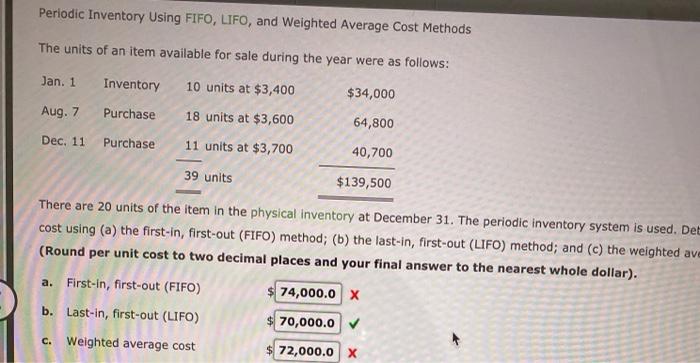

First in first out FIFO method. And c weighted average cost method round per-unit cost to two decimal places and your final answer to the nearest whole dollar.

Solved Periodic Inventory Using Fifo Lifo And Weighted Chegg Com

13 Purchase 260 units at 342 88920 Nov.

. Periodic inventory systems can make sense for small to midsized businesses with a low number of products sold while large and growing business opt for the perpetual inventory method and its. B last-in first-out LIFO method. To find the cost of goods available for sale youll need the total amount of beginning inventory and recent purchases.

1 Inventory 20 units at 360 7200 Aug. FIFO stands for First In First Out. 2 LIFO last-in first-out The cost of the ending inventory is the cost of the first units bought.

In a periodic inventory system the company does an ending inventory count and applies product costs to determine the ending inventory cost. Ending inventory Beginning inventory Purchases made during the month Units sold during the month 500 units 1500 units 1400 units 600 units 800 units 700 units 1500 1 First in first out FIFO method. As an accounting term inventory is a current asset and refers to all stock in the various production stages.

If two books were sold 90 would be assigned to the first book and 89 to the second book The remaining 350 440 - 90 is reported as the cost of the ending inventory. The good news for you is the inventory valuation methods under FIFO LIFO weighted average or average cost and specific identification are calculated basically the same under the periodic and perpetual inventory systems. The following example illustrates the use of FIFO method in a periodic inventory system.

Inventory weighted average cost. To calculate the weighted average cost divide the total cost of goods purchased by the number of units available for sale. Resulting in four methods for determining Ending Inventory costs.

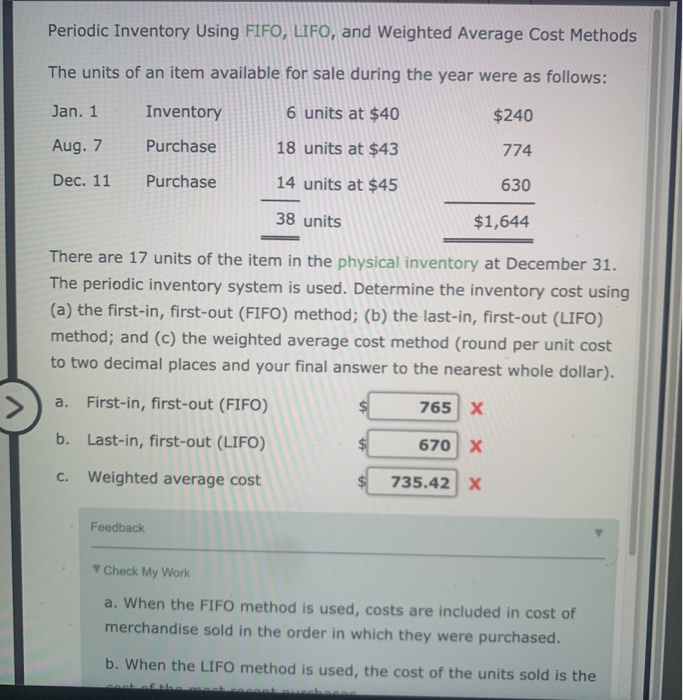

Determine the inventory cost using a the first-in first-out FIFO method. First in first-out FIFO b. Cost of goods sold COGS Beginning inventory Purchases Ending inventory.

FIFO Periodic FIFO Perpetual Weighted Average Periodic. Two types of Inventory accounting systems are. Once the cost of ending inventory has been computed the cost of goods sold can be computed easily using the following simple formula.

Determine the inventory cost using the a. Under periodic LIFO we assign the last cost of 90 to the book that was sold. Methods Under a Periodic Inventory System.

The bad news is the periodic method does do things just a. Weighted averageb Which cost fow methods resulted in the highest gross proft on sales. B the last-in first-out LIFO method.

Periodic Inventory and Perpetual Inventory SystemThere are also two Standard costing approaches. Is the FIFO Method good for handmade business. Using the FIFO LIFO or the weighted average costing method cost is assigned to the inventory that was sold during the year and is reported as cost of goods sold on the income statement.

Number of units in ending inventory. B the last-in first-out LIFO method. The final calculation will provide a weighted average value for every item available for sale.

Periodic Inventory Using FIFO LIFO and Weighted Average Cost Method. 30 Purchase 40 units at 357 14280 Available for sale 320 units 110400. With the FIFO weighted average and specific identification procedures gross profit on sales was the same.

The LIFO technique results in a bigger ending inventory since the cost of the most recent purchase is attributed to the units remaining in inventory regardless of when. The 350 of inventory cost consists of 85 87 89 89. There are three ways recognised by the IRS for valuing the cost of your inventory.

First In First Out FIFO and Weighted Average. Well go through each method along with the pros and cons of each approach so you can make the best decision for your handmade business. The periodic inventory system is used.

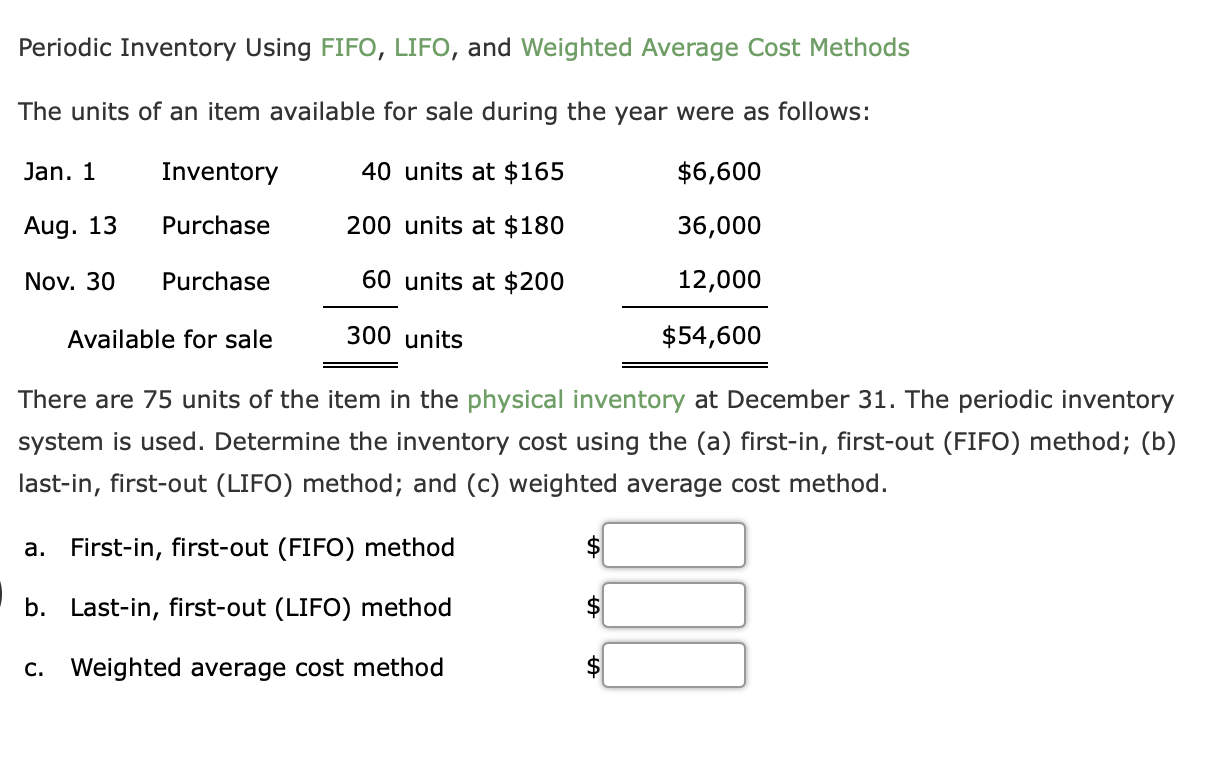

The same cost formula should be applied consistently for all inventories having a similar nature and use to the entity IAS 225-26. Using the weighted average cost method yields different allocation of inventory costs under a periodic and perpetual inventory system. The units of an item available for sale during the year were as follows.

The periodic inventory system is used. FIFO LIFO and Weighted Average Cost. And c the weighted average cost method round per unit cost to two decimal places and your final answer to the nearest whole dollar.

Cost of inventories that are interchangeable and are not segregated for a specific project should be assigned using FIFO First-In First-Out or weighted average cost formula. And c the weighted average cost method Round per unit cost to two decimal places and your final answer to the nearest whole dollar. Periodic inventory is an accounting inventory method where inventory and cost of goods sold are calculated at the end of an accounting period rather than on a daily basis.

Determine the inventory cost using a the first in first- out FFO method. The LIFO cost flow method yielded the largest final inventory. Weighted average price 165 180 2003 18167.

1 FIFO first-in first-out The cost of ending inventory is the cost of the last units bought. C Prepare an income statementdown to gross proft for December using FIFO and LIFO costing methods andassuming the 23 December purchase had been delayed until January. Last in first out LIFO method.

Ch 7 Appendix A. There are 75 Units of the item in the physical inventory on December 31. The periodic inventory system is used.

WAC weighted average cost The WAC Method under Periodic and Perpetual Inventory Systems. Determine the inventory cost using the a first-in first-out FIFO method. The periodic inventory system is used.

Solved Periodic Inventory Using Fifo Lifo And Weighted Chegg Com

Solved Periodic Inventory Using Fifo Lifo And Weighted Chegg Com

Solved Periodic Inventory Using Fifo Lifo And Weighted Chegg Com

No comments for "Periodic Inventory Using Fifo Lifo and Weighted Average Cost Methods"

Post a Comment